For native Queenslanders or those who would like to be, finding the right Brisbane mortgage broker is crucial for successfully navigating the world of finance.

In Australia, almost three quarters of new residential home loans are now written by mortgage brokers. While this figure is substantially higher than it once was, considering that mortgage brokers have access to a wide pool of financial products and offer unbiased guidance, it makes sense that more people are choosing to use one.

Regardless of whether you’re a seasoned investor, first home buyer or are simply looking to refinance, it’s no secret that home loans have the potential to be stressful. From finding the best possible interest rate to presenting your application, dealing directly with a lending institute can be intimidating if you’re not confident in how the process works. The alternative? Partnering with a Brisbane mortgage broker.

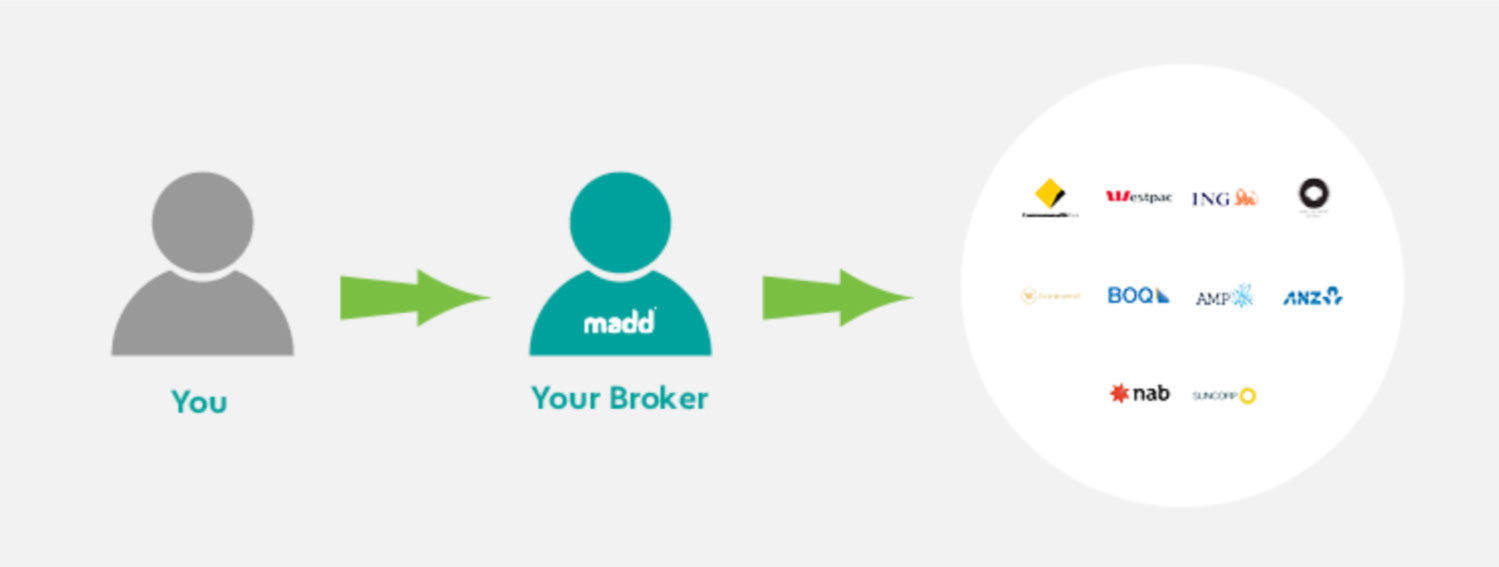

In simple terms, the role of a mortgage broker is to act as an intermediary, or someone who navigates home loan products and their applicable terms on behalf of individuals or businesses. They serve as the ‘middleman’ between the lender and the borrower and handle the time-consuming process of securing the loan and gathering the considerable paperwork involved.

The end goal is to act in your best interests when finding a home loan product and negotiating the terms on your behalf.

Once they have enough information to paint an accurate picture, a mortgage broker will calculate what an applicant can afford to borrow, source home loan products that suit the individual’s situation, and present the applicant with financial products that best match their position.

A good mortgage broker will then go on to explain how each home loan works, and what the relevant costs are such as fees and interest rates. Once the applicant decides on a home loan, the mortgage broker will then package their application in a manner that positions them in the best possible light to a lending institute, and will ultimately guide the applicant through the entire settlement process.

Although not applicable in every circumstance, it’s not uncommon for a client to stick with their mortgage broker for future financial assistance if they have received high quality customer service, and were happy with their outcome. Examples of this include returning to the same mortgage broker for assistance with refinancing, obtaining a personal or car loan, and even options to purchase an investment property. In some instances, reputable mortgage brokers also report receiving second and third generation customers based on referrals.